Learn More

Regional & Rural Market Review

THE MID-WAY POINT, WHAT NEXT FOR REGIONAL PROPERTY?

As I get older it seems the years grow smaller!

Can you believe we’re already at the mid-way point of 2024 and in the real estate game that means we’re deep into planning for our client’s Spring and Summer regional property marketing campaigns.

In my view, the big challenge for sellers of regional and rural acreage property in the second half of 2024 will be how to stand out from the crowd. Let me explain.

The first 6 months of 2024 has seen a decline in property transaction numbers across regional markets and consequently there’s now a significant back log of available property listings for buyers to choose from.

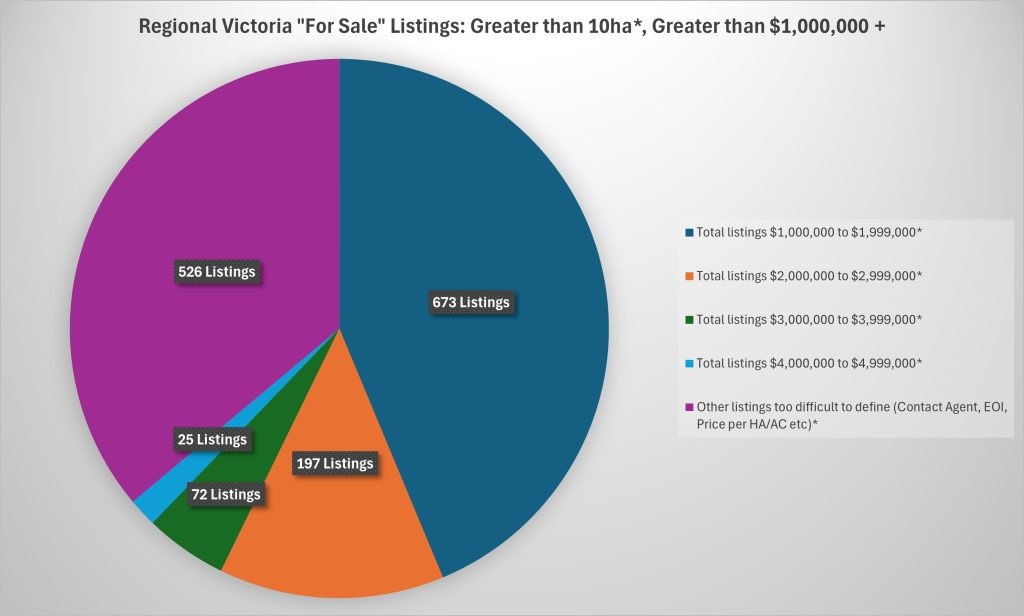

For example, if you’re a buyer in Victoria with $1,000,000 plus to spend on a property greater than 4 hectares (10 acres in the old money), you’ve got 1,457* properties to choose from!

• Taking it a step further, if you have a budget between $1,000,000 and $1,999,000 you can select from 673* regional Victorian properties right now.

• $2,000,000 to $2,999,000 you can select from 197* regional Victorian properties.

• $3,000,000 to $3,999,000 you can select from 72* regional Victorian properties.

• $4,000,000 to $4,999,000 you can select from 25* regional Victorian properties.

• There’s an additional 526* regional Victorian properties listed without a price.

I’ve appended below a paragraph from Gary Brinkworth’s month in review newsletter, CEO of Heron Todd White, that concurs with my thoughts on the regional property market for the second half of 2024.

“What we’re seeing now is a market returning to its long-term norms. Buyers remain eager but measured and well-informed sellers are probably recalibrating their expectations a little. The result should be an uptick in listings and transaction numbers as 2024 progresses. In fact, for some cashed-up buyers there could be opportunities in certain market sectors. I imagine once those predicted rate cuts do arrive, there may well be a flurry of activity that drives values higher once more. Those who act now will likely be the beneficiaries”

To view Heron Todd White’s full report please >> click here.

With a sound marketing plan in place that elevates property to the front of the pack, sellers will benefit from an increase in buyer activity over the Spring and Summer selling period.

All the best with your real estate journey.

Yours sincerely,

Jason Hellyer.

PHOTO CAPTION COMPETITION WINNER

With over 400 photo caption entries we’d like to share with you the winning entry from Susan.

“It comes down to the wire and you should be glad that it’s between us”!

To view the photo please >> click here.

Thank you, Susan!

An Akubra hat voucher valued at $275 is on its way.

To enter our next photo caption competition please make sure you follow our Ray White Rural Victoria Facebook page >> click here.

OFF MARKET – ELPHINSTONE, MOUNT ALEXANDER SHIRE

An 85* hectare, Blank canvas grazing with subdivision potential, circa $1,500,000.

To view the property please >> click here

OFF MARKET – CATANI, CARDINIA SHIRE

An 8* hectare, Country Lifestyle property with brilliant accommodation, circa $2,000,000.

To view the property please >> click here

HERE NOW – “BUDGEREE”, CATANI

133 Years of Rich Cattle & Sheep Production

With a rich history of cattle and sheep production atop green fertile pastures, the 64* hectare / 158* acre property located less than 1* hour from Melbourne’s eastern suburbs will be well sought by pastoralists and investors alike. To view the property please >> click here

HERE NOW – “RHIWLAS”, AVENEL

A Timeless Sanctuary Amidst Verdant Splendour!

Nestled on the edge of Avenel’s embrace lies ‘Rhiwlas’, a bespoke homestead boasting 169* hectares (418* acres) of gently undulating pasture. To view the property please >> click here

HERE NOW – “GRAMPIANS VIEW”, POMONAL

Lots to Pick From!

With two Lots to pick from; Lot 2 at 101* acres approximately and Lot 3 at 100* acres approximately, an inspection will give you and the family a lot to consider! To view the property please >> click here.

PRICE REDUCTION – “GAYTON GRANGE”

Swan Hill Farm Lifestyle with Income!

Located on the fringe of vibrant Swan Hill, the 8.85* hectare “Gayton Grange” property features excellent family accommodation and a well-established pistachio orchard, which has generated solid primary production income for the incumbent family on an annual basis for 19* years (P&L information available by request). To view the property please >> click here.

PRICE REDUCTION – “FISH CREEK FARM”

The Farm Named After The Town!

In the heart of Southwest Gippsland and a short drive to Gippsland’s coast, “Fish Creek Farm” is your opportunity to purchase a ready-to-go turnkey farm with outstanding cottage accommodation perfect for enjoying quality time with family, friends, and guests. To view the property please >> click here.

SEEKING A CAREER IN RURAL AND REGIONAL REAL ESTATE? CONSIDER US!

Want to be part of something big? Love the Regional Country Lifestyle? Then we’d love to hear from you!

Ray White Rural Victoria is a specialised real estate business within our Victorian network that markets and sells high-value, premium quality country lifestyle, farm and agribusiness property across the state.

With a significant uplift in property coming to market in these sectors, we’re keen to identify experienced licensed real estate agents to service the demand on behalf of Ray White Rural Victoria across places like the Goulburn Valley and Mornington Peninsula regions.

Backed by Australia’s largest and most trusted real estate brand, Ray White, you’ll be inducted into a business that provides industry leading property marketing, technology, training and administrative support to keep you ahead of the game.

To learn more about Ray White and this exciting Ray White Rural Victoria opportunity, contact Jason Hellyer on 0403 043 571 or >> click here.

And don’t forget, if you’re considering selling or buying (or even both) at some stage in 2023, please feel free to contact me or our experienced Ray White Rural Victoria team at any time for a free property appraisal.

GET YOUR PROFILE UP TO DATE!

In addition to following our social media channels, it’s important to keep your Ray White Rural Victoria profile up-to-date. Buyer demand is still far outweighing supply, and many rural and regional properties are currently being sold off market and without advertising. So it’s critical that your contact details are as current as possible so we can keep you fully informed. Those details should include:

• Your first and surname;

• Your address;

• Your mobile and/or work phone numbers; and

• Your email address.

To update your profile please >> click here.

Jason Hellyer

Managing Director

Ray White Rural Victoria

‘Off Market’ property available right now

We have a selection of quality Country & Coastal Lifestyle ‘Off Market’ property property to choose from, most within close proximity to Melbourne. To view these properties please >> click here.

Transaction case studies

To view a selection of Victorian transaction case studies please >> click here.

Request a discreet property appraisal

We would be delighted to provide you with a current property market appraisal. Please make contact with us by >> clicking here.